By Socratis Santik Oglou,

Artworks, paintings, in particular, can appear to be rather inexpensive. Most of the time people think, by looking at a contemporary painting for example, that they could recreate that by just throwing some acrylics on a piece of canvas and spending a little time onto creating the masterpiece, and then sell it for millions of dollars. But, how do you know if your work is worth $10, $1,000, or even $1,000,000?

Don Thompson writes in his book “The $12 Million Stuffed Shark: The Curious Economics of Contemporary Art”: “In a market where information is scarce and not trustworthy, the first rule is the price level signals the reputation of the artist, the status of the dealer, and the status of the intended purchaser. Prices reflect a size of work, not its quality or artistic merit.”.

In other words, that means that the biggest factor when it comes to pricing is actually the marketing of it —the branding— and not the effort in creating the piece or the quality of it. Take for example the society that we live in. A lot of people would gladly spend a couple more bucks to get a MacBook when at the same time they can find a laptop with the same specifications with half the price but without the “iconic” Apple logo in it.

Now, the question is, how do they sell art for millions of dollars?

To start with and for the most part, the artists are not the ones that are involved in it. Therefore, money is not the sole factor that determines the worth of a work of art. The key to selling artworks for millions is a strong market value and high demand.

The Prestige of the Work of Art

The prestige of the work of art, on the other hand, is another variable. Don Thompson writes in his book: “the formula for art pricing goes something like this, the bigger the work, generally the more expensive it is.” A work of art can gain recognition and acclaim in a variety of ways, like by entering the public as a result of being the topic of famous pop films, books, or advertisements, for example. Others gain prestige as a result of their provocative or controversial content, and others gain notoriety through time, or by being included in prominent collections in museums.

The reputation of the Artist – Dealers’ part – The Provenance of the Artwork

The artist’s reputation is one of the most important variables when it comes to pricing. The artist’s status, like the prestige of the work, can shift throughout time. For example, if a popular film depicts some of the artist’s work, the artist’s reputation could rise dramatically in a brief span of time. At the same time, dealers are acutely aware of these shifts throughout time and will take advantage of this reputation to raise the sales price. When there is public attention, the prestige of the artists rises, and so will the price of his work.

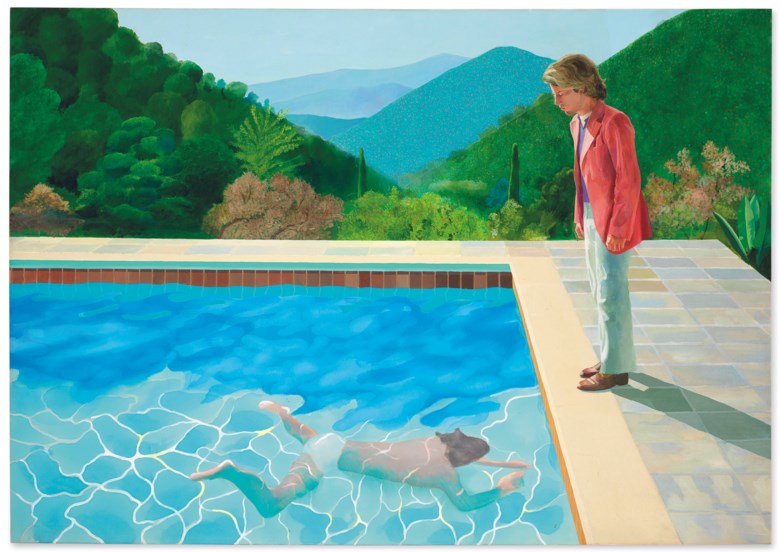

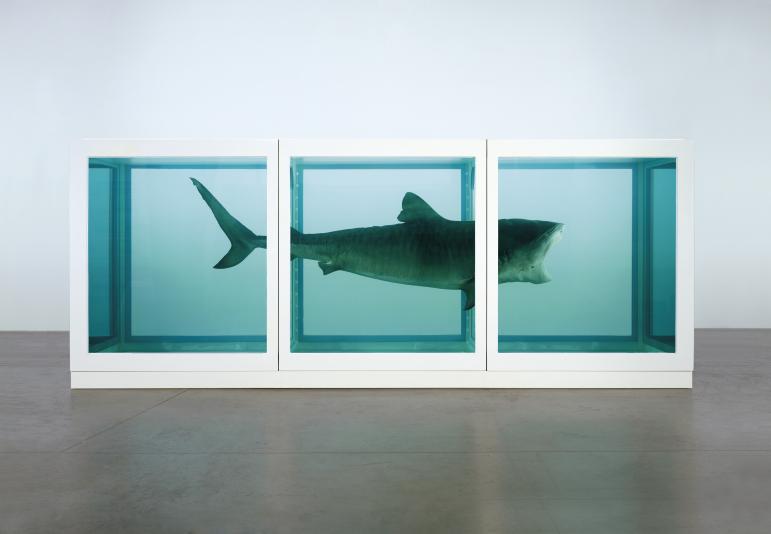

When a new artist enters the industry, however, the artist’s reputation is primarily reliant on the name of the dealer. The dealer promotes, educates, and assists artists in achieving recognition and financial success. Take for example the Shark by Damien Hirst. In the 1990s, Hirst began collaborating with Charles Saatchi, a major figure in the art world. After seeing this cow’s head at a display shortly after Hirst’s graduation in 1990, Saatchi commissioned Hirst to make anything he wanted for £50,000. Hirst purchased a shark from an Australian fisherman for £6000 and used it to make his iconic piece “The Physical Impossibility of Death in the Mind of Someone Living”. Later that year, it was sold for $12 million to Steve Cohen, a millionaire hedge fund manager. It was Saatchi’s reputation that made the piece to be sold for around 130 times the initial price.

It also makes sense when you consider how it was acquired. Dealers might use selective data to persuade potential purchasers to pay more. Another variable is the provenance of an artwork, which refers to the history of ownership of a work of art. Provenance is about ensuring that the piece is genuine and by the artist’s hand. It is valuable for tracking the history of a work of art over time. Historians utilize the former owner’s record, if one exists, to track the object’s journey through time. This gives the buyer confidence that the artwork is authentic. Furthermore, when the artwork was owned by a “famous” person and is put up for auction, the value of the work increases dramatically.

Moreover, everything, including the cost, is kept private for dealer-sold work, giving dealers the upper hand in pricing. By keeping the price private, art dealers can rely more on their reputation to make the artwork feel more valuable to the buyer. That is something that galleries and dealers fought for. Back in 1988, New York City tried to outlaw this by reinforcing the Truth in Pricing law, but galleries were protesting claiming that showing prices would “get in the way of the exhibition’s enjoyment”.

Creating scarcity is another variable when it comes to pricing. When Jenny Saville, a young British artist, got connected with Charles Saatchi back in 1999, he persuaded her to limit her work to only six paintings per year and then sold each of them for $100,000. This has to do with the marker’s rarity. The scarcity of an artist’s work, like that of many other commodities, determines its value. Take for example diamonds. In reality, it is just a rock, a pretty one, with actually no value. But, because of its rarity in the world, which has an effect that only a few can have, makes them one of the most expensive things you can buy. Produce less and sell it for more is what Charles Saatchi thought Jenny Saville.

The market value of a work is influenced by the sale price of similar works by the same artist in recent years. Artists and dealers are well aware of this issue, and they strive to strike a balance between scarcity and visibility. For example, the uplift provided by a solo exhibition must be balanced against the risk of too many pieces entering the market at the same time. To counteract this, they use this technique where a percentage of the pieces may be labeled as “sold’’ or “not for sale”, elevating the price of those that are still available.

But, at the end of the day, do artists really benefit from all of these?

Artists only benefit from primary market sales. When a collector buys a work from a gallery or, less frequently, from the artist himself, this is known as a primary market sale. When a work sells at auction, the artist doesn’t benefit at all. For decades, artists have fought for royalties from works sold on the secondary market. However, once an artist sells a piece to a collector, who subsequently sells the work to an auction house, the collector and the auction house are the only ones who profit from the sale. Only a few living artists, such as Damien Hirst or Jeff Koons are wealthy and well-known as a result of massive sales, but in reality, the majority of the artists are not and will never be.

On the other hand, even if artists do not profit financially from these sales, they may benefit in other ways. When artists’ works sell successfully at auction, their primary prices rise as a result of the dealer’s work, and their work gains awareness, which leads to recognition, which leads to a rise in pricing, as I wrought some paragraph before when there is public attention, the prestige of the artists rises, and so will the price of his work.

All of these concludes us to a $64 billion worth of the art industry market back in 2015, according to Artnet. Nowadays the market is growing outside of traditional sales of galleries and auction houses, while new selling tools and methods are being created with the emergence of the internet and online sales, when at the same time the art world maybe understanding what Saatchi taught Jenny Savile: the total value of art sold is increasing faster than the number of works available by creating scarcity. Patronage of the arts has long been a privilege enjoyed by the wealthy, and this trend is unlikely to change very soon when at the same time the dealer model still reigns supreme in the fine art industry, and the general market remains skewed toward the wealthy. However, I believe that the ability to appreciate beautiful things should not be restricted to those who can afford to purchase them.

References

- Why art is so expensive?, Vox. Available here.

- Why Do Works of Art Sell For Millions of Dollars?, Medium. Available here.

- The formula for selling a million-dollar work of art, [Video File]. Vox, Available here.