By Katerina Dimarogkona,

John Maynard Keynes, a giant in the field of economics, said: “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens’’.

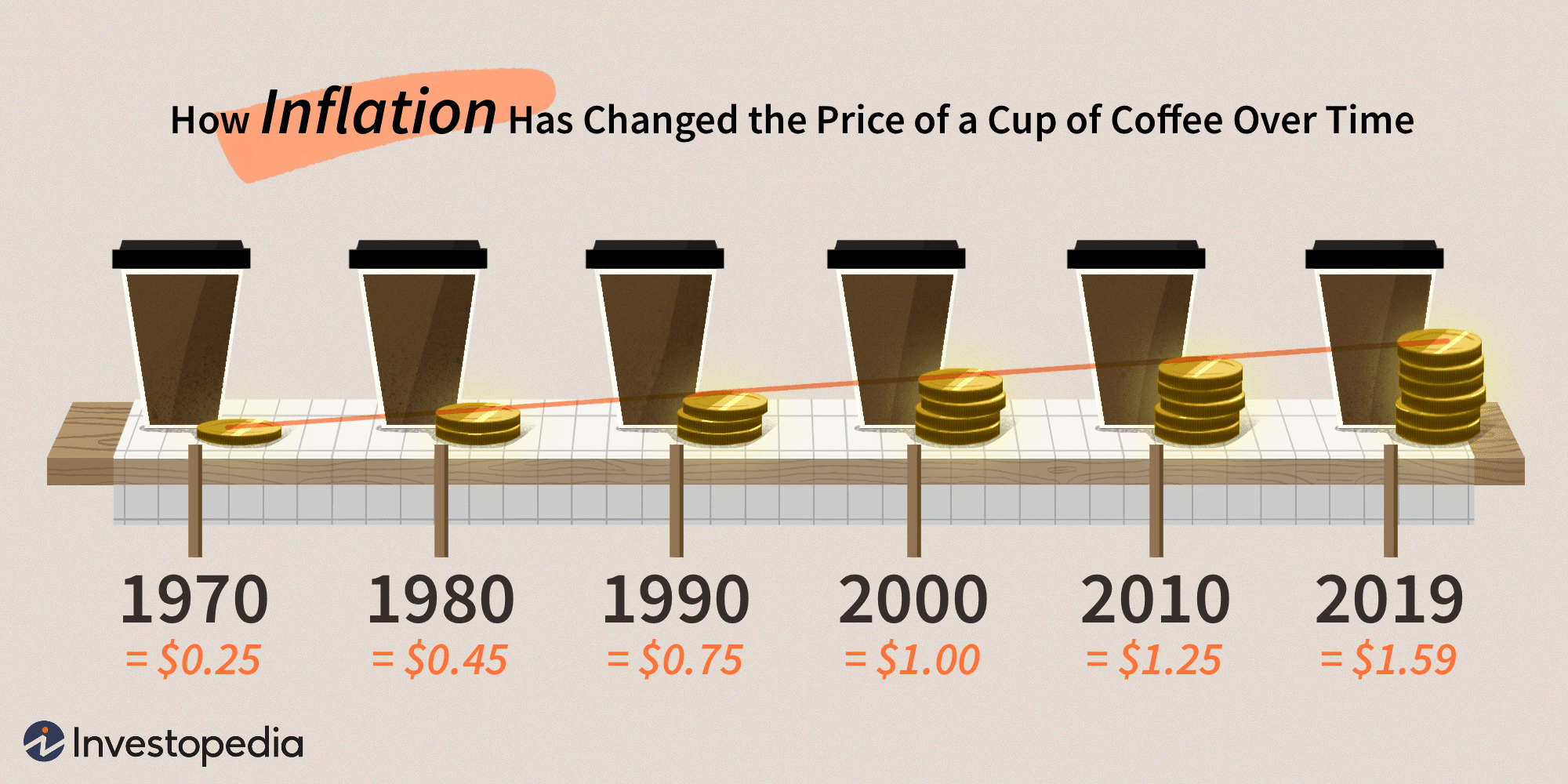

Speaking of subjects, adults fear admitting they are ignorant about inflation. Inflation is a big-time source of confusion. Why do coffee and houses cost many times more than in the time of our fathers, why are prices always rising? These are things people ask us economics students about, because fear surrounds this mysterious economic beast. And while there are a lot of talks made about inflation right now, those of us who feel shame about our complete lack of knowledge on the issue, hide in a corner to avoid such conversations. Here is some background, to alleviate confusion, and dispel misunderstandings and myths.

They document it meticulously. They watch it; government agencies, businesses, and analysts, because danger looms when there is too much of it. Hyperinflation is a destructive disease of the economy. As witnessed in the wild though, inflation is nothing but money becoming less valuable. The money in your wallet can buy a smaller amount of stuff, having less purchasing power. It is a general rise in prices that does not really happen simultaneously across all consumer goods, but we will ignore that for now. Wages supposedly raise the same amount as the prices and cancel out the effect of things becoming more expensive, and if that is true, why is it considered such a threat to economic prosperity?

Hyperinflation does not affect everyone the same way. As prices rise, those with a stable income effectively become poorer. It corrodes people’s savings, and the pensions of low-income earners often becoming not enough for them to live by the time they come to retire. The pension and the savings account stay the same, while the cost of living keeps rising. Though in a small amount it is a natural part of the economy, high inflation harms the working class. It does not harm most business owners who get paid at current prices, investors, and the wealthy, who often invest their money. So, inflation does not change the amount of wealth that exists, but silently redistributes it. Currency loses value and those who can demand higher prices end up richer; the rest stuck with money that can buy less than they thought it could.

There are three reasons for the existence of inflation. Cost-Push Inflation is when either the materials, the land, or labor gets more expensive for a company, and then the company passes the cost down to the consumer (if they are willing to buy at higher prices, of course). That happens because of some environmental disasters, because of governmental regulations, monopoly power, and other such causes. Cost-push Inflation was show-cased memorably in 1973, when OPEC restricted the supply of oil and caused the famous 1973 oil crisis. OPEC owned a large amount of the world’s supply of oil, and their monopoly power let them intentionally restrict the supply of oil to sell at a higher price.

Then there is the Demand-Pull Effect, which is when there is such high demand for consumer goods because of freely available money and credit, that demand rises faster than production capacity. There is “too much money chasing too few goods’’. People willing to pay higher for something because it is scarce causes prices to increase. A good example of demand-pull inflation is in part what we are going through right now. Stimulus packages gave a lot of time and money to people, which they want to spend. As a result, prices have been increasing rapidly (and because of the war in Ukraine).

Interestingly, an effect of the two previous types of inflation is more inflation, called Built-In Inflation. When prices are rising, afraid that current inflation rates will keep being where they are, people fear that their money will be worthless in the future and so they start spending right now. But that, as we have seen causes Demand-pull Inflation. All of that is measured by the CPI and others.

Imagine a basket full of things the average person uses every day, from food to all kinds of things. The prices of such a basket added together and weighted are used to measure the rate of inflation. While not a perfect measure of inflation for numerous reasons, the CPI helps because it gives us an image of the future value of money which is very important, because chaos and uncertainty in economic transactions do not help economic activity to flourish.

The common question I get asked still remains. Why do we not just aim for no inflation, why do we not just stop printing money. Well, apart from turning grandma’s savings to dust, Inflation also has some desirable qualities and is beneficial in a small amount to the economy. If we wanted to have almost 0% inflation, we could have that. But it turns out that 0% inflation and deflation, the phenomenon where prices are reduced, is even worse for society than regular inflation. People stop spending, and that brings the economy to a halt. What is always important is not to get lost in the seemingly complicated language of economics, and to learn about patterns that directly affect our lives. Knowledge about how the society we are a part of works can only be empowering.

References

- Thomas M. Humphrey, Keynes on inflation, Federal Reserve – Bank of Richmond, richmondfed.org, Available here

- What Causes Inflation and Who Profits From It?, investopedia.com, Available here