By Eleni Metanoia,

It is undeniable that climate change and environmental degradation present an existential threat not only to Europe but also to the rest of the world.

According to the Intergovernmental Panel on Climate Change (IPCC) report of 2014, 2018, and 2021, only in Europe, over the past decade (2010-19), near-surface temperatures were 1.7-1.9 °C higher than pre-industrial levels, compared to a rise of around 1 °C across the globe. 2020 was the warmest year on record in Europe, while the number of disasters caused by natural hazards is increasing, with extreme natural events more than doubling globally since the 1980s.

The United Nations’ Intergovernmental Panel on Climate Change estimates that limiting the temperature increase to 2 °C, which was the goal of the 2015 Paris Agreement, will require about $3 trillion of investments every year to 2050. Therefore, it is expected that tackling climate change and its impacts will not be cheap. For that reason, in recent years, more and more governments and corporations tend to use alternative strategies such as green bonds to deal with climate change in the most efficient way possible.

What are Green Bonds?

Green bonds are titles of debt issued by different Central Banks around the globe that are helpful to fund key environmentally sustainable projects and grant investors revenues at specific intervals of time.

These bonds may come with tax incentives such as tax exemption and tax credits, making them a more attractive investment in comparison to a traditional bond. In addition, they are often verified by a third party such as the Climate Bond Standard Board, which certifies that the bond will fund projects that include benefits to the environment.

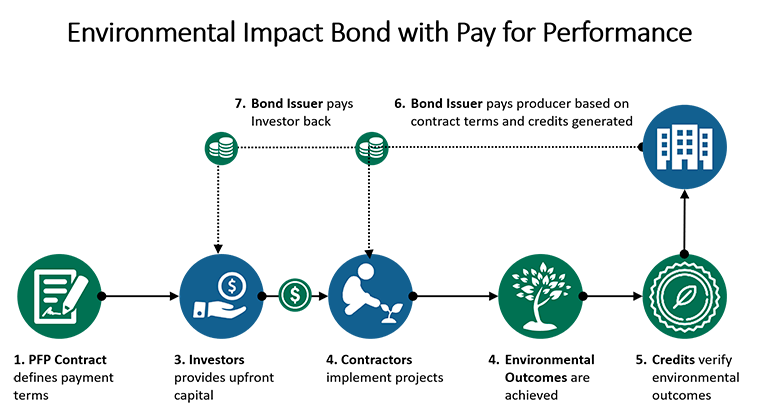

Green bonds work just like any other regular bond, with the key difference being that the money raised from investors is used exclusively to finance projects that have a positive environmental impact.

The first green bond was issued in 2007 by the European Investment Bank, while the World Bank is a major issuer of green bonds that has issued $14.4 billion of green bonds since 2008. These funds have been used to support 111 projects around the world, largely in renewable energy and efficiency (33%), clean transportation (27%), and agriculture and land use (15%).

According to the Climate Bonds Initiative, the annual issuance of green bonds could hit $1 trillion in 2023. The United States has been the main producer of green bonds so far, but the EU is on track to become the market’s most powerful force, with plans to issue approximately $300 billion in green bonds over the next five years, to fund sustainable initiatives. EU countries such as France, Germany, and the Netherlands have already issued their own green bonds.

Given the climate change crisis, the leaders of the European Union realized the need for a new economic growth strategy that will transform the Union into a sustainable, resource-efficient, and competitive economy. Thus, in December 2019, the European Commission presented the so-called “European Green Deal” (EGD). The EGD sets out how to make Europe the first climate-neutral continent by 2050, by providing a roadmap with actions to boost the efficient use of resources by moving to a clean, circular economy and outlining the need to better direct financial and capital flows to green investments.

The Commission also committed to establishing a “European Green Bond Standard” as part of its 2018 Action Plan on Financing Sustainable Growth, while on July 6, 2021, the Commission published its proposal for a Regulation on European Green Bonds.

The EU Green Bond Standard and the Regulation on European Green Bonds

The proposed Regulation intends to establish a “gold standard” for how firms and governments may utilize green bonds to generate financing on capital markets to fund large-scale initiatives while achieving stringent sustainability standards and protecting investors.

This will be beneficial for both issuers and investors of green bonds. On one hand, issuers will have a robust tool to demonstrate that they are funding legitimate green projects aligned with the EU Taxonomy, which is a classification system, establishing a list of environmentally sustainable economic activities. On the other hand, investors buying the bonds will be able to easily assess, compare, and trust that their investments are sustainable, thereby reducing the risks posed by greenwashing.

The principle behind the Regulation is that the EU Green Bond Standard should be a voluntary standard that is built on market best practices and will be open to any issuer of green bonds, including companies, public authorities, and issuers located outside of the EU.

The key elements of the Regulation

The key elements of the proposed legal framework are four. The first has to do with the “taxonomy-alignment”, meaning that the net proceeds raised by the bond should be allocated fully to projects that meet the EU taxonomy. For a bond to meet the EU Green Bond Standard, the Regulation requires full transparency on how the bond proceeds are allocated through detailed reporting requirements.

Since the Commission believes that external reviewers play a crucial role in maintaining the integrity of the green bond markets, the Regulation proposes requirements for external reviewers concerning transparency, professional qualifications, and avoiding conflicts of interest. The European Securities and Markets Authority (ESMA) must register and monitor external reviewers in order to verify the quality of their services and the credibility of their evaluations, to safeguard investors and maintain market integrity.

The European Union, along with its institutions, has taken decisive steps toward, creating a sustainable financial market, as well as a clear and reliable public framework for the European Green Bond Standard. This would strengthen confidence that green bonds are helping to assist the transition to a greener economy, improve data availability and openness, and improve green bond comparability, dependability, and, as a result, efficient pricing.

The existing industry standards for green bond labels rely on definitions of underlying green projects that are not sufficiently standardized or reliable, something that undermines the credibility of the green bond market, and thus, reduces the demand due to greenwashing concerns and possible reputational risks for issuers and investors.

Furthermore, the lack of a standardized reference framework and reporting templates raises the transaction costs of green bond issuance, lowering their economic appeal.

At this point, the European Central Bank is crucial to be able to reliably identify and evaluate environmentally sustainable bonds by providing a high level of transparency and strengthening the green credentials. Thus, stronger safeguards against sudden revaluations of green bonds following individual cases of greenwashing will be provided as well as market functioning and financial stability will be achieved.

Besides, creating a trusted regulated environment that supports the issuance and creation of European green bonds will play a key role in promoting the euro’s international role, as well as assisting in the development of Union financial markets into a new “green finance” hub, thereby bolstering EU green investments. It is of paramount importance that the Commission provides technical support and guidance to the Member States, so as to help them to promote effectively the European green bonds at a national level as well.

References

- The World Bank Impact Report 2020-The World Bank Sustainable Development Bonds & Green Bonds, 2020, thedocs.worldbank.org, Available here

- 2021 Green Forecast Updated to Half a Trillion-Latest H1 Figures Signal New Surge in Global Green, Social & Sustainability Investment, climatebonds.net, Available here

- A European Green Deal, ec.europa.eu, Available here

- European green bond standard, ec.europa.eu, Available here

- Definition of Green Bond, investopedia.com, Available here