By Katya Mavrelli,

Oil prices are for another time on the increase after an epidemic and a price competition sent them tumbling in 2020. We are amid the new oil price supercycle, which has been driven by supply shortages from the shortage of investments that has been ongoing since the 2014 collapse in oil prices, also as by demand growth that has been triggered by global optimism about vaccines. Most of those elements are likely to steer to a rise in consumption, yet the looming green transition and therefore the orientation towards different technologies make the longer term of oil less certain.

Energy transition has a big impact on the Arab States of the Gulf, as they plan to move faraway from economic reliance on hydrocarbon exports. Hydrocarbons are the dominant components of petroleum and processed petroleum hydrocarbons, like gasoline and diesel. Saudi Arabia and thus the United Arab Emirates have emerged as the key regional players of this energy transition with the latter having already formulated an idea of domestic reforms, beat line with the transition towards greener technologies to take care of its dominance over the energy sector. The latter is going through a harder time designing a consistent energy policy given the disagreements between the varied emirates, notably Abu Dhabi and Dubai, but the key leadership position it occupies, remains. The Arab Gulf region maintains a robust competitive advantage over other regions across the world, given the plethora of natural reserves, which are complemented by investments in greener technologies within the last decades.

The global transition to an energy system with lower CO2 emissions will have an enormous impact across the planet. The broader shift away from liquids, like oil and fuels, and towards gas and other sources of energy, like nuclear energy, means the international community is undergoing a huge transformation. For many years, the reliance on oil implied that national economies became inextricably linked to the movement of oil prices and their progress throughout the global financial system.

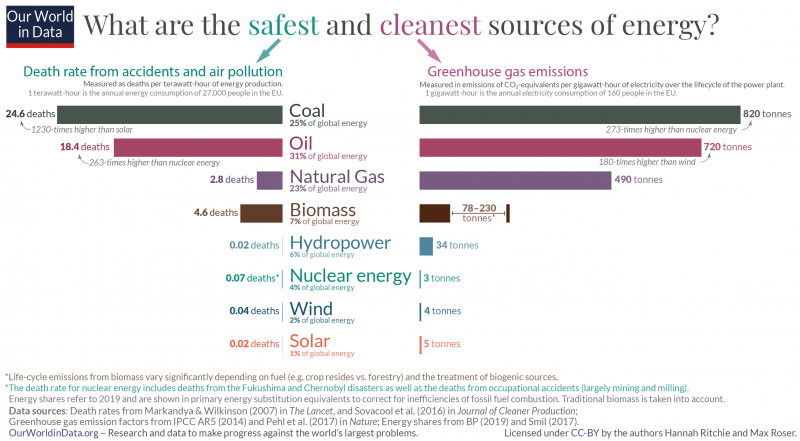

The safest and cleanest sources of energy coincidentally are also the countries which have the tiniest impact on the climate considering death rates per unit of energy data and thus greenhouse emissions (GHG) per heat unit, which considers the whole carbon footprint over the entire lifecycle. Thanks to the symmetry of the chart produced after analyzing the 5th report of the Intergovernmental Panel on global climate change (IPCC), it is evident that the safer energy sources, like wind and solar energy, also are the safest and least polluting ones, given low death rates.

Even with lower oil prices, extraction and exploration companies have remained highly profitable, yet they have reduced their investments out of fear of a less stable future for the energy sector. Production in oil fields and thus the amount of wells are declining and depletion of reserves is accelerating, as long because the decrease in cost and oil reserve replacement has followed a gentle path since 2014. The pandemic magnified the decrease in investment within the oil sector: the oil output is increasing only by 0.5 million barrels a year, compared to 2 million barrels a year before the pandemic. The Biden Administration has also adopted a greener approach as far because the energy sector cares. It has announced a ban on drilling on federal land, which signals a shift within the attitudes of the federal towards the oil industry.

Recent technological developments are pointing to the transformation of the energy sector more directly than the subtle policies that national governments are beginning to consider. For instance , the capitalization of Tesla, the electrical carmaker, signals the transformation of the car market and widens the gap between those that can follow along during this transformation and people which will need to be left behind. The overall sentiment of competition that has embraced the planet of energy has also triggered massive investments in research and development by companies that wish to enter the green industry more powerfully and ‘stay on top of their game’.

The Energy Transition Index (ETI) could also be a composite index that creates a threshold, consistent with which world economies can position themselves supported their efforts to understand net-zero emissions and transform their economies according to greener standards. The systematic movement towards a more sustainable energy sector has been accelerated, especially a reduced reliance on imported energy, lower energy subsidies, and powerful political commitment to transform the energy sector to satisfy national and international targets. Sweden is ranked first within the list of countries undergoing such energy transition, followed by Switzerland and Finland.

As the incorporation of electricity is becoming more visible, the complementing of green projects by uranium could even be a solution. As oil prices perform somersaults, nuclear energy becomes the solution for several who wish to secure their place within the global economy.

This has been the story of Iran, a nation that has followed developments within the energy sector very closely and has managed to adapt relatively well. Soon after the nationalization of the Iranian company within the 1950s, Iran has entered and exited the petroleum stage multiple times. It has turned from a peripheral actor, into a dominant player and a pacesetter within decades. Nowadays, it has changed its status from a previously marginalized actor into a nation fully enmeshed in energy developments. The infamous nuclear energy sector has allowed Iran to maintain a better standard compared to its Arab neighbors, but it has turned all international attention to its national political developments.

Although the word “Iran” conjures up images of its uranium enrichment and nuclear plant development programs, and although its relationship with oil remains complex, the petroleum industry remains a key sector for the Iranian economy. The new government, led by Ebrahim Raisi, will take determined steps towards the redefining of Iranian domestic policy associated with the energy industry and therefore the petroleum sector. A greater emphasis on self-sufficiency and a desire for fewer reliance on the Middle East as well as the West are two elements that have led to the acceleration of the crisis within the oil price sector and therefore the hardening stance regarding nuclear deal negotiations. Iran is a case study within the greater context of green transitions. The recent oil price supercycle seems to be according to climate goals and associated with commitments by large economies to realize net-zero carbon emissions shortly. Despite this climate-friendly approach, a sudden departure from the realm of oil will have immediate consequences for petroleum-reliant economies, resulting in the emergence of more crises and further highlighting the existing instability. Oil-dependent economies within the Middle East, Central Asia, and Latin America are important sources of employment and external demand for goods, and any disruption within the ‘business as usual’ mentality will have international implications.

This is why a progressive and systematic transformation must happen. Oil-dependent countries got to diversify and incorporate tools in their decision-making that help them become resilient to changes, not only within the market but also within the political and societal framework. The introduction of renewable energy in these countries’ immediate line of sight will be imperative for the survival of their economies. Changing attitudes towards innovation, by reforming national and native governance systems also as promoting markets without barriers to entry or exit are going to be key elements within the green transition.

References

- Annika Hedberg, Stefan Sipka, ‘Towards a green, competitive and resilient EU economy: How can digitalization help?’, European Policy Center, December 13th, 2020. Available here.

- Goda Naujokaityte, ‘Better science communication is needed to deliver the green transition’, Science | Business, September 9th, 2021. Available here.